Bullshit-free investment advice

Do not take the information written in this article simply at face value! Investment is complex and requires a lot more knowledge than this smallish brain dump. Consider it more of a cheat-sheet; an introduction for anybody wanting to learn about savings in general.

Ok so you have some money that you want to put aside for a rainy day? Great that’s a fantastic start but now you don’t exactly know what to do with it. Since 99 % of the currencies of the world are inflationary (meaning that a central authority can print more at any time or make it dissapear ![]() ) putting that money in a standard bank account with close to no interest would be stupid; that money needs to be put to work and earn interest on your behalf! There are several ways to do this. This article is a general introduction to global savings and doesn’t take into account regional specificities and potential tax efficient situations you might encounter.

) putting that money in a standard bank account with close to no interest would be stupid; that money needs to be put to work and earn interest on your behalf! There are several ways to do this. This article is a general introduction to global savings and doesn’t take into account regional specificities and potential tax efficient situations you might encounter.

First of all we usually categorize assets (stuff that you own) in two categories: ‘liquid’ and ‘not so liquid’. Liquid stuffs are the stuffs you can sell very quickly without too much trouble, the latter also has inherent value but is harder to move around (think of dolla’ dolla’ bills yo vs a rare pontiac from the 70s).

Secondly everything you own has a dynamic value (example: a house can triple in value over 10 years) representing your net worth and that value is a compound of all the stuffs you have (it’s the cornerstone of a capitalistic system, which is now predominant in 100 % percent of all countries). The goal of having a savings strategy is to maximize the growth of your net worth. In other words, the money your assets generates while you sit on your ![]() doing nothing.

doing nothing.

Investing in tangible assets

Should you buy real estate?

There is no such thing as free real estate sadly… Investment decisions are often clouded by psychological bias. For instance in many countries it is generally regarded that the best kind of investment a young adult can make is buy her own flat/house because its safe and that way she doesn’t have to pay rent which alleviates the pains of life in a peculiar way. Well this is only true if you buy real estate in a real good up and coming area, otherwise a portfolio of securities will yield better returns in the long run.

OMG I just had a thought. (I know, occasionally it still happens).

— Noah Smith (@Noahpinion) December 4, 2017

In Japan, workers get seniority-based raises. In America they often don't.

So HOUSE PRICE APPRECIATION became the vehicle by which Americans turned age into dignity.

PROTIP: One thing that is really good with this kind of investment is that you can easily ask for money lending to purchase it. And if the lending rate is low it can be a good deal.

Should you buy gold or other rare items?

In general it is good practice to invest in what you know and value. For instance if you’re a wine connoisseur speculating on wines could be a good fit for you because of the endowment effect you might experience when holding it. Gold is generally a solid investment because it’s rare and the value can only go up over time (unless Asteroid mining becomes a thing, but we’ll put a pin in that) but it’s not very practical. In general this category should not be your main focus of allocation but can yield solid returns if done wisely. So here the answer is mixed, definitely not a no-brainer.

But wait a second, how do stuffs get a price tag in the first place? Who decides that?

One can only know how much something is worth by asking how much another guy would pay for it, at scale, through global marketplaces. For instance stocks are traded globally by thousands of computers routing their needs to a common ‘stock market’ and it is only by having people selling their stocks there that you can determine the average value of that stock. And this true for everything our world has to offer, only offer and demand determine the value of your belongings.

Investing in abstract assets

The marvellous land of Indexed Funds

Side note: one basic assumption to make before diving into more details is that the stock market is complex and influenced by an extremely wide array of external and internal factors which basically makes it one gigantic computational problem. It is by design extremely difficult to intuitively anticipate market movements. Thus most human-made investment decisions will be relatively poorly made in regard to their robot counterparts. Even Warren Buffet who is probably the most successful investor of all times agrees that seemingly premium funds are not worth the premium price.

This doesn’t mean that actively managing securities is not something to pursue but just that’s it’s an incredibly difficult problem that requires heavy real-time data analysis and accurate prediction models, very few companies have been able to do it successfully and consistently (most notably Renaissance Technologies).

What the fuck is a fund?

A fund is essentially just money from several individuals pooled together in order to generate returns collectively (because 4 % returns on 10 000 000 € is better than 4 % returns on 10 000 €, amiright?). There are lots of types of funds but they can mostly be clustered in 3 categories.

| Fund Type | Category | Key characteristic |

|---|---|---|

| Mutual | active | Wealth manager actively invests the money. |

| Indexed | passive | Money is automatically following a market index. |

| Hedge | active | Mutual Fund with restricted access and fancy technology to hedge against the market. |

You can buy parts of it through a reseller which will most likely be a bank either selling those products bare (just the product) or with extra services (monitoring tools, rebalancing, etc). For instance in germany one of the leanest retailers of securities is Flatex.

Ok now what is a portfolio?

It is a fancy name to designate all the tradable stuff you have but mostly in the context of finance. For example if you bought through your bank some stocks well those stocks plus the ones you might already have compose your portfolio.

What is active, what is passive?

A fund is considered active when humans make decisions about the allocation of the stuffs, on the other hand a passive fund relies on automatic processes (like following an index).

What the fuck is a wealth manager ?

A wealth manager is a human or group of humans that intensely look at Excel spreadsheets in order to devise investment strategies (securities to buy) for your money, on your behalf.

What the fuck is an Index?

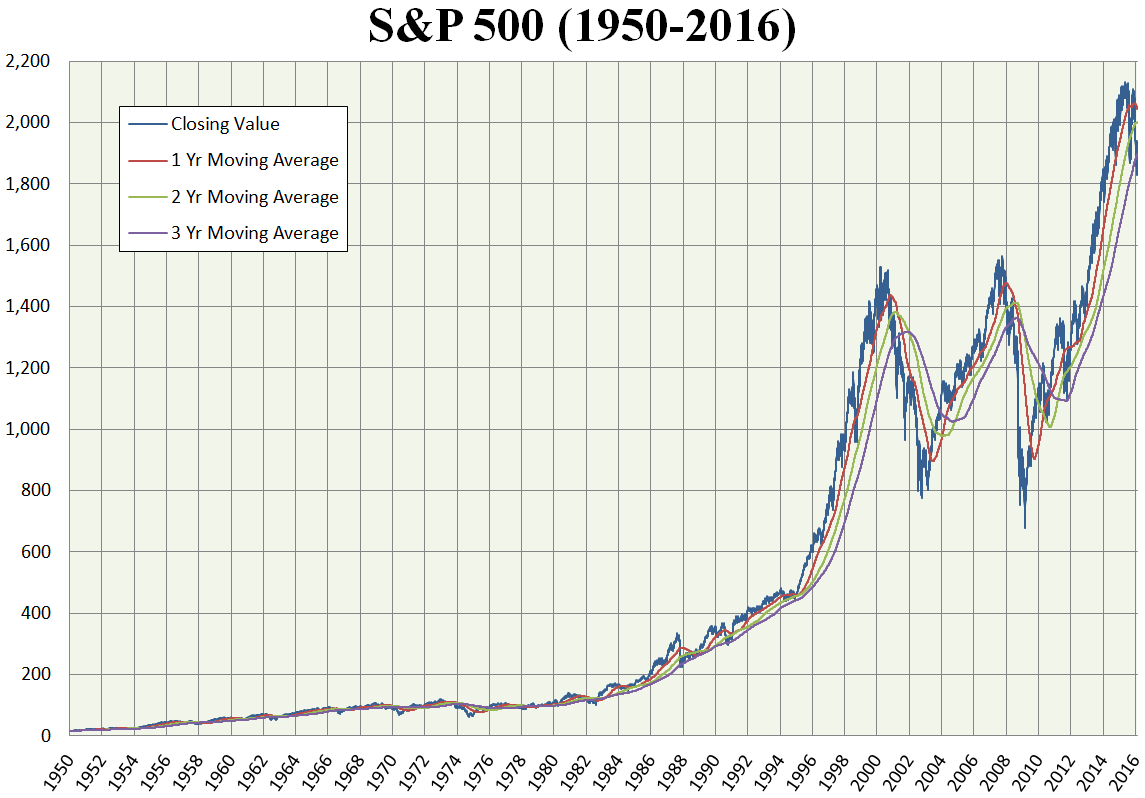

It’s a measurement of the value of a section of a market. It is meant to represent the overall trend of an aggregate of companies. For example the S&P 500 is an index. Historical evidence shows that very few active fund managers can outperform indexes. The fund buys parts of the leading companies in a country in an effort to profit from the overall growth of the whole country’s private sector.

Why are indexes so badass?

PROBLEM: The stock price of a specific company can fall to the ground in seconds and humans are extremely bad at forecasting stock prices.

SOLUTION: Buys lots of different stocks of leading/established/growing companies (not manually but through a fund) to make your portfolio bulletproof ![]() , bang bang.

, bang bang.

This is all very nice but what about the saving plans offered by my bank?

This is a tricky one. Most saving plans provided by banks today have very low yearly returns with a maximum around 4% for the luckiest. With a good portfolio of securities you can expect around 6% a year. The crucial factor here is the tax/fee schema offered by your bank’s financial products. Ask your banker how the product she offers you is different from an indexed investment to find answers.

PROTIP: always fact check and do your own math when talking to your banker because it’s not 100% guaranteed that your incentive and hers are aligned.

Yeah but what about those pesky financial crises like 2008?

In 2008 most people that lost money are the ones who panick sold their positions anticipating the dip. But on a long enough timespan we can say that the markets recovered quite nicely (here is a document that describes more exactly what happened to the S&P500). So if you chill in case of crises you’re good to go (easier said than done tho ![]() )

)

Is this magical? What’s the catch? ![]()

The main magic ingredient is called compound return and is the reason why starting early and holding very still is so critical. It’s the mathematical reason why a 1 cent initial investment with a 100% daily return would result in 10 million in 30 days. On a more realistic scale: if you invested 10.000 $ in 2000 in the S&P500, you would have about 21.600 $ in 2017.

When and how much should I save?

Start investing as early as possible in order to leverage the compound effect nicely. The amount is not really important as long as you build the habit of sparing some money for your future.

What about taxes? ![]()

As long as the money stays stored in something (a security or a token for example) you don’t get taxed on price fluctuations of course. Taxation happens when you fall back to a national currency. In that case it really depends where you originated from or work from.

Why is this boring as hell?

Good investment is boring, steady and safe (same rule applies to software). But to spice things up one could decide to invest in green business, prisons, military equipment, porn, robotics which will yield interesting diner conversations about morality at the next family reunion. Another option could be to invest in the very opaque and fraudulent global art market, probably the most unregulated market known to mankind. Invest wisely and ethically.

I heard about crypto-currencies having insane yield, where can I buy some of that?

As much as indexed funds are old proven technology crypto-currencies are from a totally different world. They are akin to currencies but not issued by any central bank of any government and are only subject to the rules of the code (written by a small group of maintainers). The whole subject is too complex to detail in this article but just know that as currencies are being issued their popularity and market capitalization (the total value of all units) tends to go up meaning the value of a single unit also tends to go up because of limited offer.

Crypto-currencies are extremely new and risky assets but they can yield extremely fruitful returns, for instance Bitcoin’s price increased 180% in 2016 (which shines a lot compared to an average 4-6% on a regular portfolio). I would not recommend putting all your savings in crypto currencies no matter the amount of risk you think you can handle because this could all flatten out in a second, but on the other hand if you’re looking for potentially good bets on the future this is probably one of them. Between March and June 2017, the total market capitalization (ie the amount of value put in all cryptos) has gone from 25 to 100 Billion USD. This is has raised so much interest that Hedge Funds are quietly investing in it to better their average performance.

I highly recommend adhering to the social, political and technical aspects of the founding principles of the blockchain. A lack of understanding can cause cognitive bias and very sub-par allocation decisions. For example Bitcoin is not just a digital currency, it’s a protocol of communication. To understand where Bitcoin is located on the human timeline of groundbreaking inventions you can have a look at the following video:

If you want to go deeper in understanding how Bitcoin (and other crypto-currencies) works under the hood the book of reference is Mastering Bitcoin. Otherwise you can learn how Bitcoin works with emojis. This invention is extremely hard to fully grasp because it intersects both Computer Science (distributed systems, open source technologies, version control, network protocols) and Economics (free market, offer and demand, inflation, deflation). A firm understanding of both renders the task less daunting and it’s such a big deal that the MIT plans to open a curriculum for it.

Here is another good video that adresses legitimacy concerns which are numerous when you come to think of it for the first time:

If you have done your homework already and consider yourself informed enough and willing to invest you can head towards one of the many exchange places online where you can buy crypto tokens with fiat currency. At the time of writing of this article one of the most reliable exchange is Kraken. Once you have managed to successfully land your crypto of choice in your exchange account I highly recommend moving it to a wallet under your full control. You can see the question debated by traditional investors being discussed in this reddit thread to forge your own opinion.

ULTRAPROTIP: whatever you wanna buy stay away from ICOs because most of them are either scam or overly ambitious or very premature or a nasty combination of all 3.

Diversification is

In order to have relatively stable decent returns every year it is necessary to diversify the assets in your portfolio as much as possible according the modern portfolio theory. This allows you to spread the risk and make your porfolio more resilient to sudden market changes. What that means is that if you get super stacked on the passive investment side then you can allow yourself to get that nice apartment and über hipster crypto tokens portfolio which you can monitor on your phone using Blockfolio.

TL;DR how to invest your 💰

— Pieter Levels @ 🇳🇱 (@levelsio) October 13, 2017

- 10% high risk (bitcoin)

- 40% medium risk (stocks, real estate, ETFs)

- 50% low risk (bonds, p2p lending)

Conclusion

Diversify your portfolio and hold tangible assets and financial products in order to guarantee a certain amount of safety. When buying financial securities only buy Indexed Funds and ETF, buy early, hold, reap the fruits later. It’s like growing a garden. If you are young and without too many downpayments you can consider investing in crypto-currencies which are the most high-risk/high-reward asset class that exists right now.